Business Working Capital Loans: A Complete Guide

Introduction

Every business, whether small or large, encounters moments when additional financial resources are needed to cover daily operations. This is where business working capital loans come into play. These loans are designed to provide the necessary funds to bridge cash flow gaps, ensuring smooth business operations. In this guide, we will explore everything you need to know about working capital loans, their benefits, application processes, and much more.

What Are Business Working Capital Loans?

Definition

A working capital loan is a type of financing that helps businesses meet their short-term operational needs. Unlike long-term loans used for purchasing assets or large projects, these loans focus on funding day-to-day expenses like payroll, rent, or inventory.

Why Are They Important?

Working capital loans are crucial for maintaining liquidity, especially during periods of slow revenue generation or unexpected expenses. They provide businesses with the flexibility to operate efficiently without financial strain.

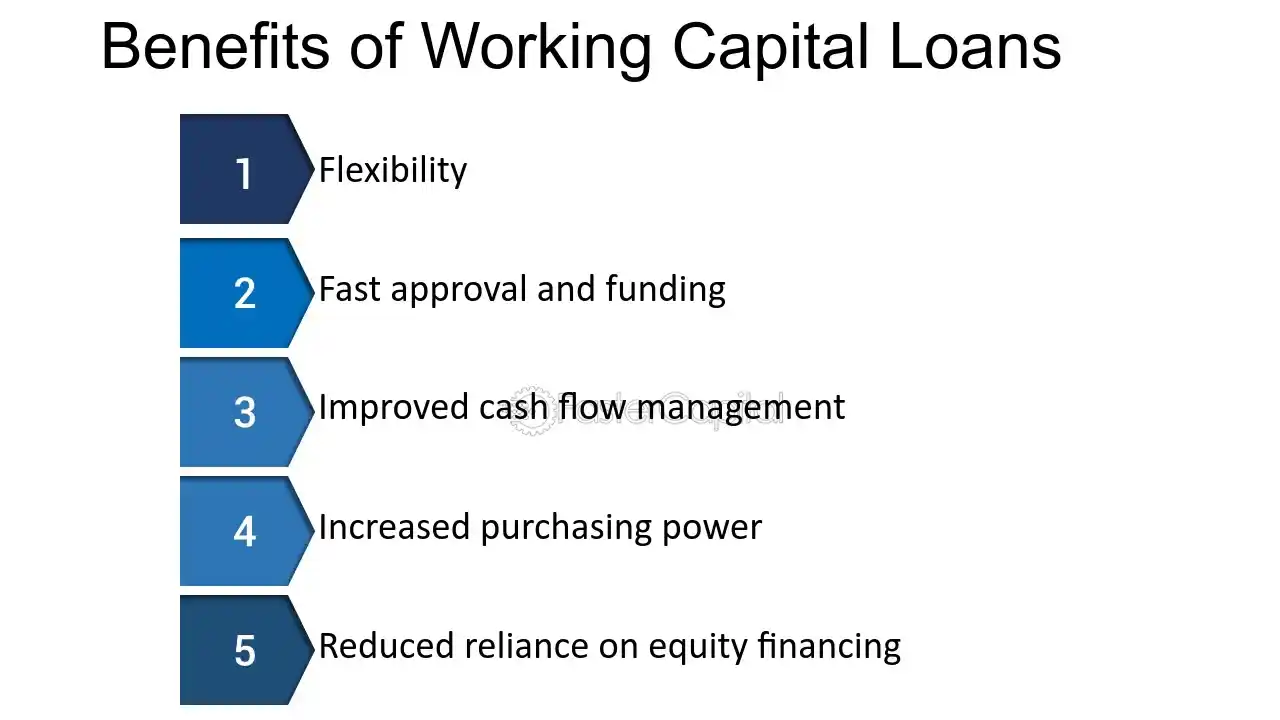

Benefits of Business Working Capital Loans

Ensures Smooth Operations

By bridging cash flow gaps, working capital loans allow businesses to pay bills, suppliers, and employees on time.

No Need to Pledge Assets

Many working capital loans are unsecured, meaning businesses don’t have to offer collateral.

Quick and Flexible Access

Most lenders process working capital loans quickly, making them an excellent solution for urgent financial needs.

Types of Business Working Capital Loans

Short-Term Loans

These are lump-sum loans that need to be repaid within a short timeframe, typically ranging from 3 to 18 months.

Line of Credit

A revolving credit line allows businesses to borrow only the amount they need and pay interest on the borrowed sum.

Invoice Financing

Businesses can use unpaid invoices as collateral to receive immediate cash flow.

Merchant Cash Advances

A lump sum is provided upfront, and repayment is made through a percentage of daily sales.

How to Determine the Right Loan for Your Business

Assess Your Financial Needs

Determine the purpose of the loan—whether it’s to cover payroll, purchase inventory, or manage seasonal fluctuations.

Compare Loan Options

Research different types of loans, their interest rates, repayment terms, and eligibility criteria.

Consult a Financial Advisor

If you’re unsure about the best option, seek advice from a financial expert to make an informed decision.

How to Apply for a Business Working Capital Loan

Step-by-Step Guide

- Understand Your Requirements

Clearly define how much funding you need and for what purpose. - Prepare Your Documents

Gather necessary documents like financial statements, tax returns, and bank records. - Research Lenders

Compare banks, online lenders, and credit unions to find the best fit. - Submit Your Application

Fill out the loan application form and provide the required documents. - Review Terms and Conditions

Before accepting the loan, ensure you understand the repayment terms and fees.

FAQs About Business Working Capital Loans

What is the typical interest rate for working capital loans?

Interest rates vary but usually range from 5% to 30%, depending on the lender and your creditworthiness.

Can startups qualify for working capital loans?

Yes, but startups may face stricter eligibility requirements and might need to provide collateral or a guarantor.

How long does it take to get approved?

Most lenders approve applications within a few days, especially for online loans.

Business working capital loans are invaluable tools for maintaining financial stability and driving growth. Whether you’re a small business owner navigating seasonal challenges or a large company seeking flexibility, these loans offer tailored solutions to meet your needs. By understanding the types, benefits, and application process, you can make informed decisions and secure the financial support your business deserves.

Stay informed, explore your options, and empower your business with the right working capital loan today!