How to Apply for an SBA Loan: Your Complete Guide

Applying for an SBA loan can be a game-changer for your small business. These government-backed loans provide competitive terms, lower interest rates, and extended repayment periods, making them an excellent option for business owners. This guide will walk you through the process, ensuring you’re well-prepared to secure the funding you need.

What is an SBA Loan?

Understanding SBA Loans

An SBA loan is a financing option backed by the Small Business Administration (SBA) and provided through approved lenders like banks and credit unions. The SBA guarantees a portion of the loan, reducing the lender’s risk and allowing small businesses to access favorable terms.

Types of SBA Loans

- 7(a) Loans: Ideal for general business expenses.

- CDC/504 Loans: Designed for purchasing fixed assets like real estate or equipment.

- Microloans: Smaller loans up to $50,000 for startups and micro-businesses.

Am I Eligible for an SBA Loan?

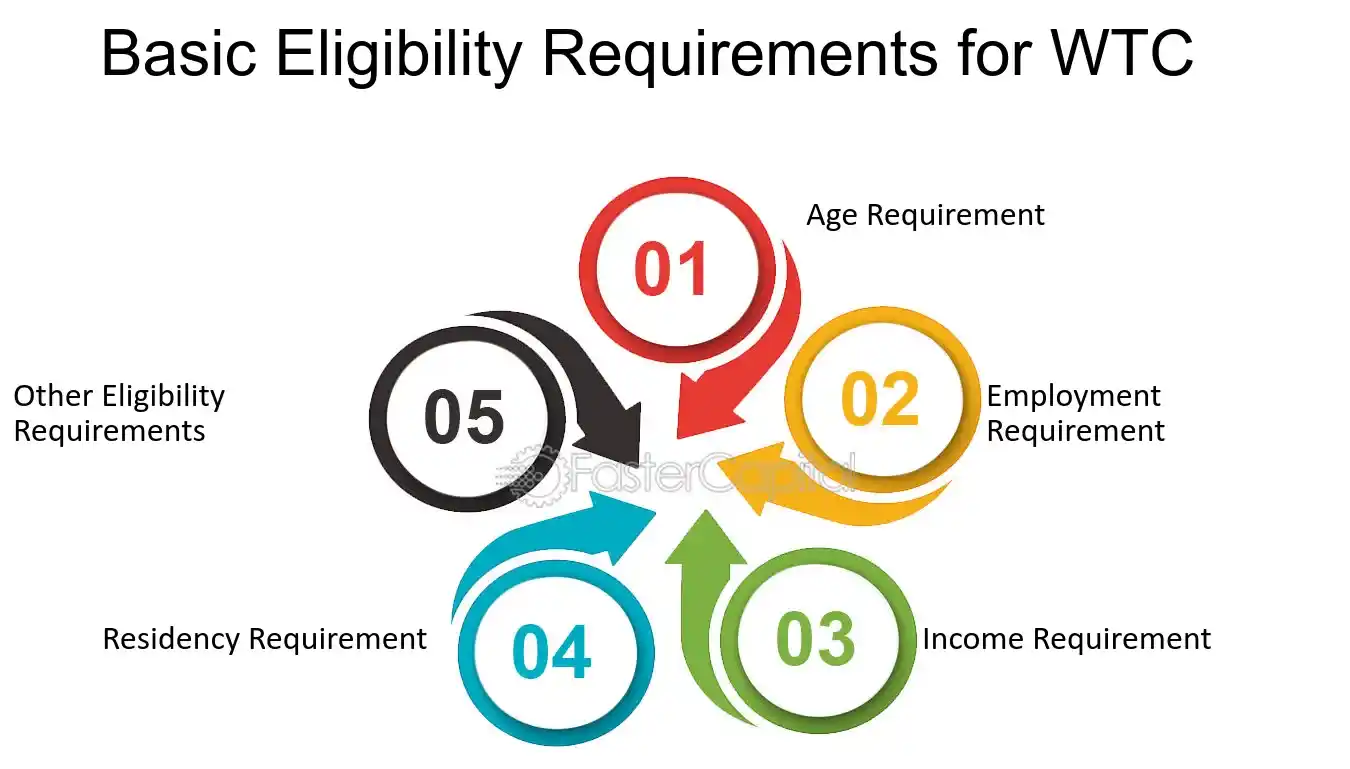

Basic Eligibility Requirements

To qualify for an SBA loan, your business must meet certain criteria, including:

- Operating as a for-profit entity.

- Being located in the U.S.

- Meeting size standards defined by the SBA.

- Having reasonable owner equity to invest in the business.

Common Reasons for Rejection

- Poor credit score.

- Lack of collateral.

- Insufficient business experience or revenue.

Step-by-Step Guide to Applying for an SBA Loan

Step 1: Gather Required Documents

Before you apply, ensure you have the following documents ready:

- Business financial statements.

- Tax returns (business and personal).

- Business plan detailing your goals and financial projections.

- Loan application form (Form 1919).

Step 2: Choose the Right SBA Loan

Decide which SBA loan type best suits your needs based on the purpose of the funding. For instance:

- Opt for a 7(a) loan for working capital.

- Consider a CDC/504 loan for purchasing large assets.

Step 3: Find an Approved SBA Lender

Search for SBA-approved lenders in your area. You can use the SBA’s Lender Match tool to find lenders that fit your requirements.

Step 4: Submit Your Application

Submit your completed loan application and supporting documents to your chosen lender. Be thorough to avoid delays in processing.

Tips for a Successful SBA Loan Application

Prepare a Strong Business Plan

A well-crafted business plan demonstrates your vision, goals, and repayment strategy. Include detailed financial projections and market analysis.

Focus on Your Credit Score

Both personal and business credit scores impact your eligibility. Aim to maintain a score above 680 for the best chances of approval.

Be Transparent

Disclose all relevant financial information. Any discrepancies or omissions could hurt your application.

What Happens After You Apply?

Loan Approval Process

Once your application is submitted, the lender will review your documents and assess your eligibility. If approved, the funds can be disbursed within weeks, depending on the loan type.

If Your Application is Denied

If your loan application is denied, don’t lose hope. Ask the lender for feedback, improve your application, and reapply.

Resources to Help You Apply for an SBA Loan

Downloadable Tools

- SBA Loan Application Checklist

- Sample SBA Application Form

Expert Guidance

Consider consulting with financial advisors or loan experts to streamline the application process.

Success Stories

Many businesses have thrived thanks to SBA loans. For example:

- A family-owned bakery expanded its operations using a 7(a) loan.

- A tech startup secured funding for new equipment with a CDC/504 loan.

Applying for an SBA loan might seem complex, but with the right preparation and resources, it can be a straightforward process. By understanding the requirements, gathering the necessary documents, and presenting a strong application, you’ll increase your chances of securing funding to grow your business.

Start your journey today—download our free SBA loan checklist and take the first step toward achieving your business goals