Equipment loans are vital financial tools for businesses of all sizes, enabling them to acquire essential machinery and tools without draining cash reserves. This article provides a comprehensive overview of equipment loans, their benefits, types, and practical tips for securing the best loan for your needs.

What Are Equipment Loans?

Understanding Equipment Loans

An equipment loan is a type of financing specifically designed for purchasing business-related equipment. These loans help businesses acquire machinery, vehicles, or technology while spreading the cost over time. Equipment loans are typically secured, meaning the purchased equipment serves as collateral.

Why Equipment Loans Are Essential

For many small businesses, upfront costs for essential tools or machinery can be prohibitive. Equipment loans allow businesses to invest in growth without compromising cash flow, making them a strategic choice for scaling operations.

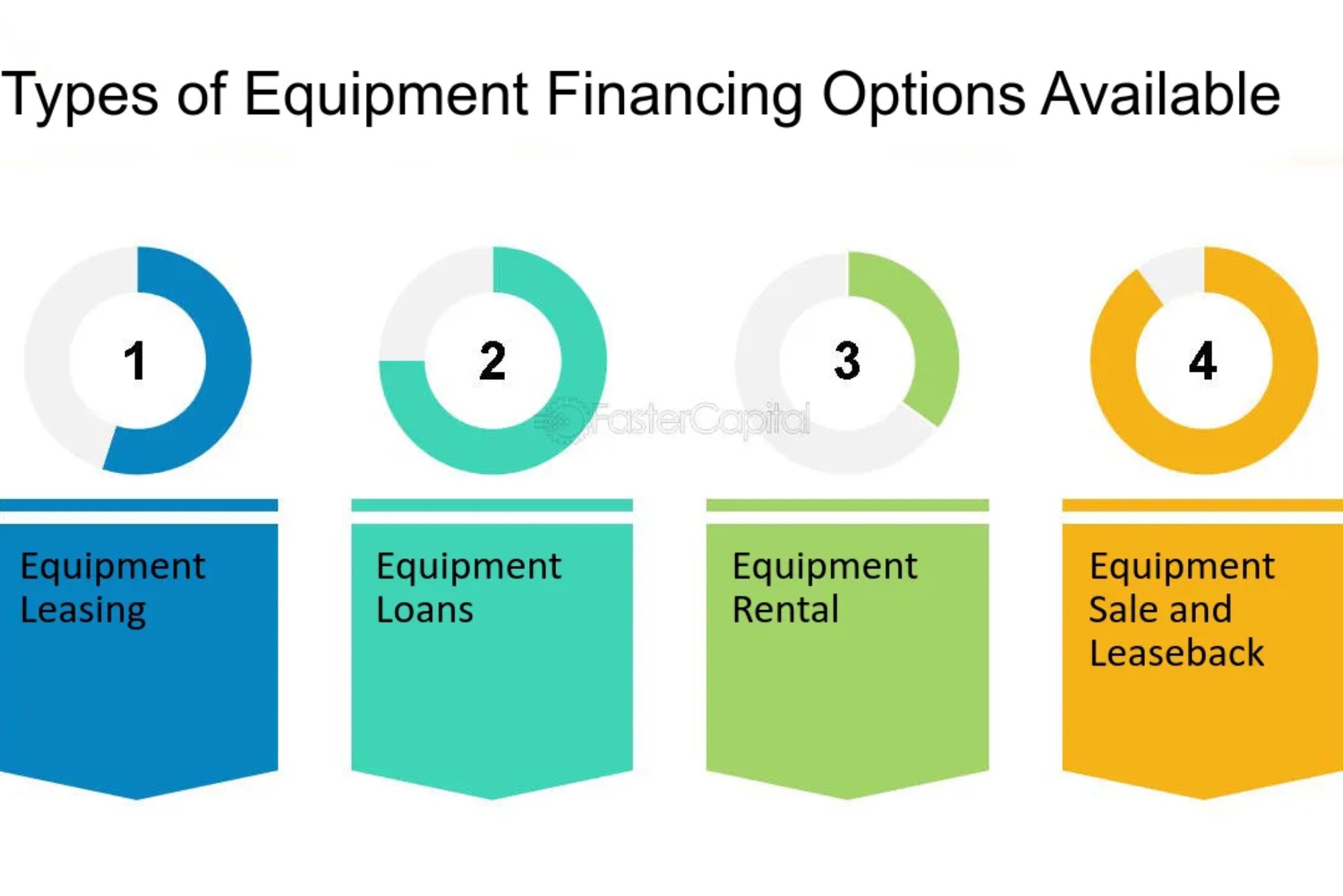

Equipment Loans vs. Equipment Leasing

Key Differences

While equipment loans involve purchasing the equipment with borrowed funds, leasing provides temporary access to equipment for a fixed period. Loans allow businesses to own the equipment outright once repaid, whereas leases might involve ongoing costs or purchase options at the end of the term.

Which Option is Better for Your Business?

- Choose loans if ownership is critical or the equipment has long-term utility.

- Opt for leasing if equipment becomes obsolete quickly or requires frequent upgrades.

Types of Equipment Loans

1. Heavy Machinery Loans

These loans cater to industries like construction, manufacturing, and agriculture, helping businesses acquire costly machinery such as bulldozers, tractors, or CNC machines.

2. IT and Office Equipment Financing

Ideal for businesses needing computers, software, or office furniture, these loans are usually smaller in size but essential for operational efficiency.

3. Industry-Specific Loans

Tailored for specialized sectors, such as medical equipment loans for healthcare providers or kitchen equipment financing for restaurants.

How to Apply for an Equipment Loan

Steps to Apply

- Identify the equipment your business needs.

- Research lenders specializing in equipment loans.

- Prepare the necessary documents, such as financial statements and business plans.

- Submit your application and await approval.

Common Requirements

- Business and personal credit scores

- Proof of revenue and profitability

- Details of the equipment being financed

Choosing the Best Loan for Your Business

Factors to Consider

- Interest Rates: Compare rates across lenders to minimize costs.

- Loan Term: Match the loan term to the equipment’s useful life.

- Fees: Look for hidden charges such as origination fees or prepayment penalties.

Pro Tip

Work with a financial advisor to assess your business’s capacity to repay the loan without compromising other operational needs.

Top Equipment Loan Providers

Online Lenders vs. Traditional Banks

- Online Lenders: Offer quick approvals and flexible terms, suitable for small businesses.

- Traditional Banks: Provide lower interest rates but involve a more stringent application process.

Comparison of Popular Providers

| Provider | Interest Rate | Loan Term | Unique Feature |

|---|---|---|---|

| Bank A | 6.5% | 3-7 years | Low collateral requirements |

| Online Lender B | 8.2% | 1-5 years | Quick disbursal |

FAQs About Equipment Loans

1. Can I get a loan with bad credit?

Yes, some lenders offer loans to businesses with poor credit, but interest rates may be higher.

2. What happens if I can’t repay the loan?

The lender may repossess the equipment used as collateral.

3. Are equipment loans tax-deductible?

In many cases, interest on equipment loans and depreciation of the equipment are tax-deductible. Consult with a tax advisor for details.

Equipment loans are a lifeline for businesses seeking growth through critical investments. By understanding the options, application process, and key considerations, you can make informed decisions that align with your business goals. Whether you need heavy machinery or IT tools, the right equipment loan can help take your operations to the next level.

Would you like additional resources or examples to accompany this article?